Competitive Advantages

Competitive Advantages

East West Bank’s Bridge to Home adjustable loan program offers various options to help applicants qualify for a home loan. It is a program that is beneficial for those who do not fit into the “standard boxes” of mortgage lending.

- Multiple ways to qualify – flexible underwriting

- No Social Security Number required

- No minimum credit score required

- No U.S. tax returns required

- No U.S. citizenship required

Open PDF brochure of East West Bank's Bridge to Home Loan Program

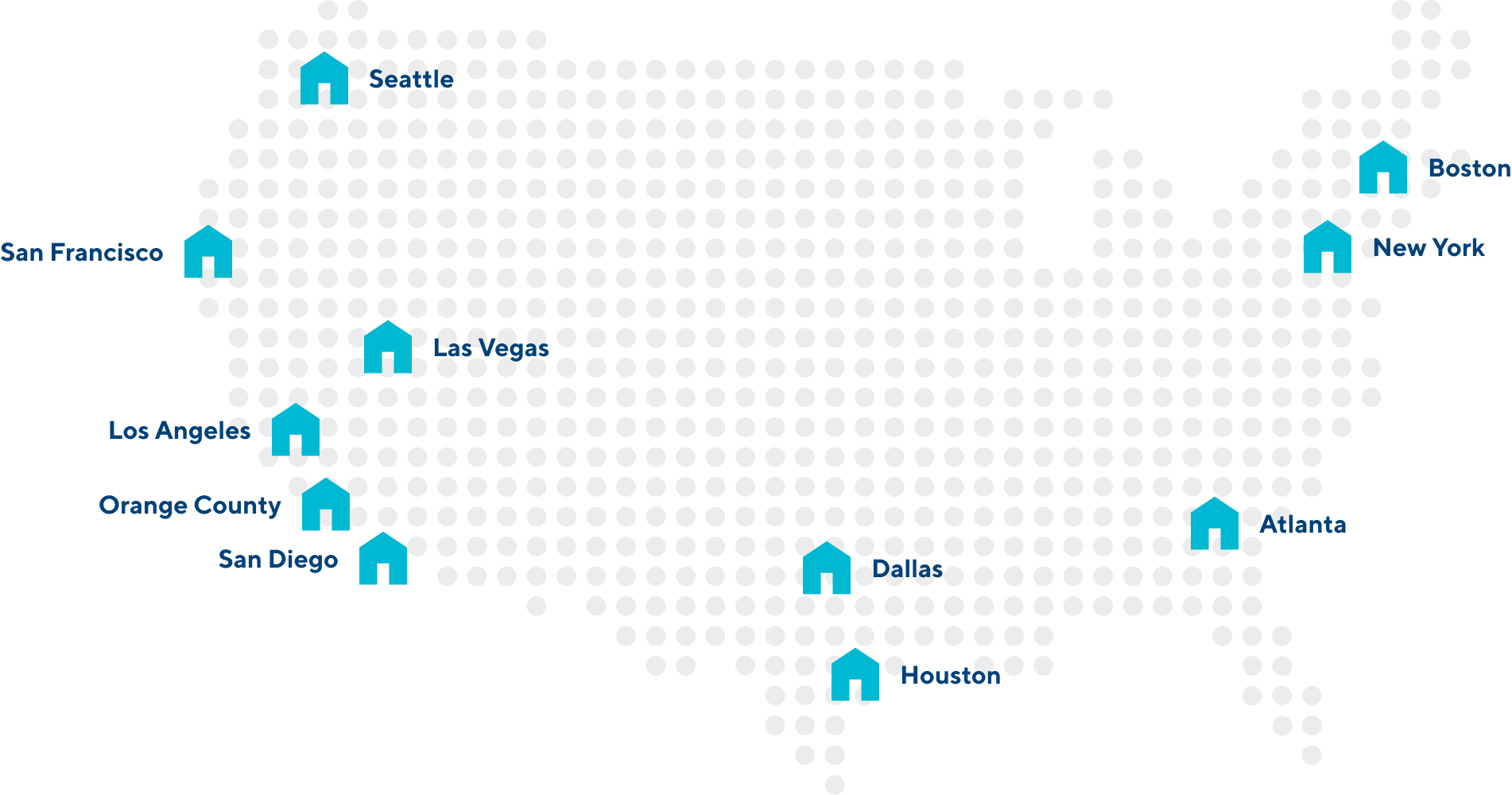

Major Markets

Apply today

You can apply easily online. After receiving your application, our bilingual Mortgage Loan Officer will contact you.

All rates, fees, products and program guidelines are subject to change or discontinuance without prior notice. Other limitations and restrictions may apply. All loans subject to East West Bank’s application, underwriting, appraisal and credit approval. Program available in select counties of California, Georgia, Massachusetts, Nevada, New York, Texas, and Washington. A cash-out refinance is allowed only on Second Homes and/or Investment Properties in the state of Texas.

East West Bank offers mortgages on properties in select areas within the United States. The mortgage loan documents and transactions will be conducted in English. If you do not read or speak fluent English, you will need to retain a reliable translator. The Bank is not responsible for, and you will not rely on, translation by the Bank. All transactions will be conducted in the U.S.; an attorney-in-fact can sign loan closing documents if appointed by a legally acceptable Power of Attorney. A valid government-issued ID card is required for all applicants for identity verification purposes.